Why Choose Us

Check out the great services we offer

Legitimate Process

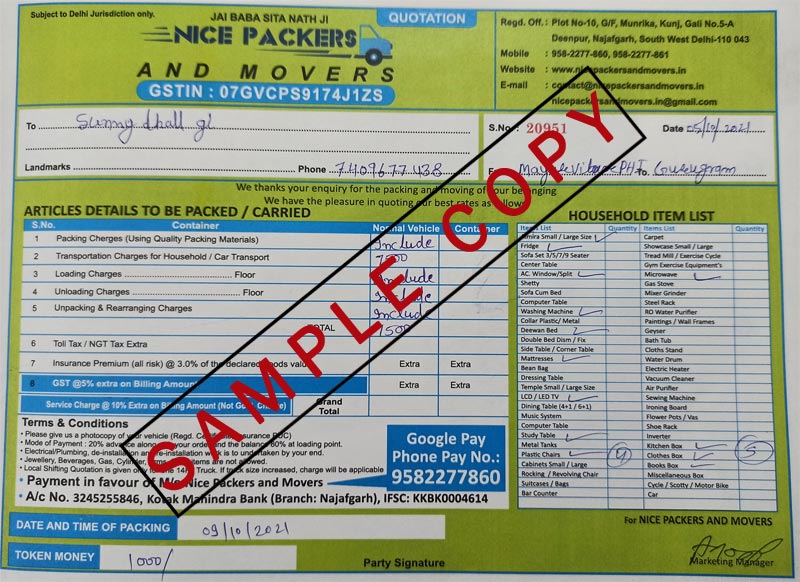

100% legitimate process of relocation bill generation

Verified Bill

Valid and verified bill of packers and movers with GST No.

Hard Copy of Bill

You get a hard copy of packers and movers bill to submit in your company

Simple Process

Very simple process to claim your movers and packers bill

Packers and Movers Bill For Claim Gurgaon - GST Invoice

How to find the GSTIN number in a Packers and Movers invoice? How to take legal action against rogue movers? And where to find the original documents? In this article, we will discuss all these issues and help you find the original documents of movers and packers. So, without further ado, let's start! Read on! Until the end of this article, we hope you have found this information useful.

Tax on movers and packers invoices

GST, or goods and services tax, is a mandatory component of movers and packers invoices. It is applied on the transportation charge of goods, which must be 5% of the total cost. Other services, including packing and unpacking, require a minimum 18% tax. Companies are required to include these items in their invoices, but they should segregate them. Listed below are some things to look for in movers and packers invoices.

Quotation Copy

These are the necessary documents you need to claim your relocation allowance.

GST is applied on moving and packing services

The GST rate is 18% for all services, excluding insurance, which is exempt. You must pay additional taxes if you are moving luxury goods. However, IBA-approved packers and movers will advise you on these matters and will provide you with an insurance claim form. However, if you are hiring a logistics company for a specific purpose, you will need to pay only the appropriate tax.

GST is calculated by using the unified GST code (SAC)

SAC identifies the service and gives it a dimension. It also defines the tax structure. Businesses with a turnover between 1.5 to 5 crores are required to obtain a two-digit SAC. Companies with a turnover above five crores must obtain a four-digit SAC. To avoid surprises, it is best to request for an online quote to avoid having to pay more than you originally anticipated.

Legal Actions Against Rogue Movers

Many Americans choose to hire professional movers to take care of their move. However, there are a variety of rogue movers out there. FMCSA reports that 4,000 to 5,000 complaints of mover fraud are filed annually. A program known as MoveRescue was set up to help consumers find reputable movers and offer legal help and advice. A MoveRescue representative will meet with a consumer and assess the situation to determine if the mover is a fraudulent company.

Florida has been particularly aggressive in bringing lawsuits against rogue movers. A lawsuit against All My Sons Moving and Storage in 2016 was among the first steps of the state's efforts to combat rogue movers. On December 28, 2018, the state announced a new major effort to combat rogue movers. The state cited FMCSA authority to bring four lawsuits against fourteen moving enterprises, including All My Sons Moving and Storage and Moving Company. However, not all of these lawsuits are filed in federal court.

In Canada, companies are required to have licenses from the Canadian Association of Movers (CAM) and the Federal Motor Carrier Safety Administration (FMCSA). The DOT and FMCSA have both issued and revoked licenses for rogue movers. However, there is no national licensing program in Canada, and legal requirements for moving companies are determined by each province. Further, some provinces have their own licensing requirements, which can be difficult to locate.

Finding original documents

If you're planning to move, it's important to have all of your documents in order, including the original movers and packers GST invoice. You'll need to provide the original documents to your moving company as proof of the value you put on the goods. The company will check these documents, and they'll be passed on to you. These documents will be useful for submitting claims and ensuring the relocation process goes smoothly.

In addition, the GST invoice must be original and should contain the correct information. If the invoice is missing any of the required information, it is likely to be a fraudulent invoice. The trader's GSTIN should also be listed on the invoice. If you're unsure about the validity of a GST invoice, you can always file an FIR to ensure you're getting a genuine claim.

You should also look for the item list, which is an important document to ask for, if you want to make a claim. The item list is an important document for a bill claim, as it includes insurance and rearranging of items. The bill will have the GST number and any additional charges. Lastly, you should look for the invoice with the GST number and check the originality of all the documents.

Our Home Shifting invoice Services Across India

Our Blog

What are Packers and Movers and What Do They Do?

So, you are here to know what is packers and movers. Well, they are generally known as moving companies.

List of 10 Best Cities for Jobs in India

It is really tough to get a job specially when you have done hard work with your degree. However, if you...

Learn how to build good habits for success

I want to talk to you about one of the most important aspects of achieving success - building the right habits.