Why Choose Us

Check out the great services we offer

Legitimate Process

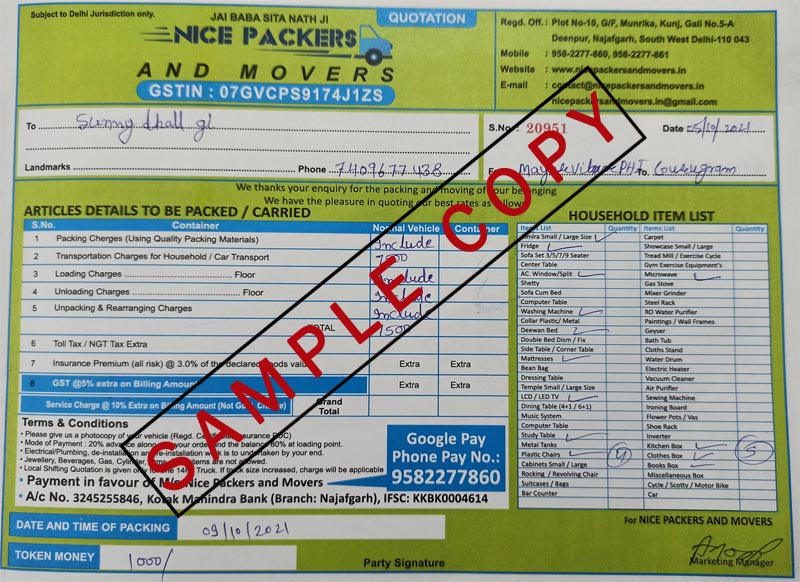

100% legitimate process of relocation bill generation

Verified Bill

Valid and verified bill of packers and movers with GST No.

Hard Copy of Bill

You get a hard copy of packers and movers bill to submit in your company

Simple Process

Very simple process to claim your movers and packers bill

Packers and Movers Bill for Claim Hyderabad

Looking to get a packers and movers bill for claim Hyderabad? Then we are here to provide you approved bill with a GST stamp. We serve our clients with a top-notch bill for claim generation process without digging a hole in their pockets. So what exactly is a bill for claim? Bill for claim is nothing but proof that you have genuinely done the shifting process. An estimate or invoice is provided by the packers and movers in Hyderabad before you even start the relocation process. By presenting this bill to your employer, you can reimburse shifting expenses.

Process That We Follow

Here is the simple process that we follow to make our deal transparent and fruitful for our clients.

- Once client contact us we listen to them and understand their requirements.

- After listing all the requirements, we came up with a sample Bill for packers and movers Hyderabad which can give a rough idea about the bill.

- Once the client approves the sample we come up with the original bill with GST no, Seal, Signature, LR no, and truck details. Along with 6 supporting documents.

- At this stage, we are ready to deliver the invoice once our client releases the payment. The client has to share the proof of payment.

- At last, we share the soft copy of the document, and a hard copy will be sent through your residential address.

Supporting documents

These are the supporting documents that we provide to our clients with the Home Shifting bill for claim in Hyderabad.

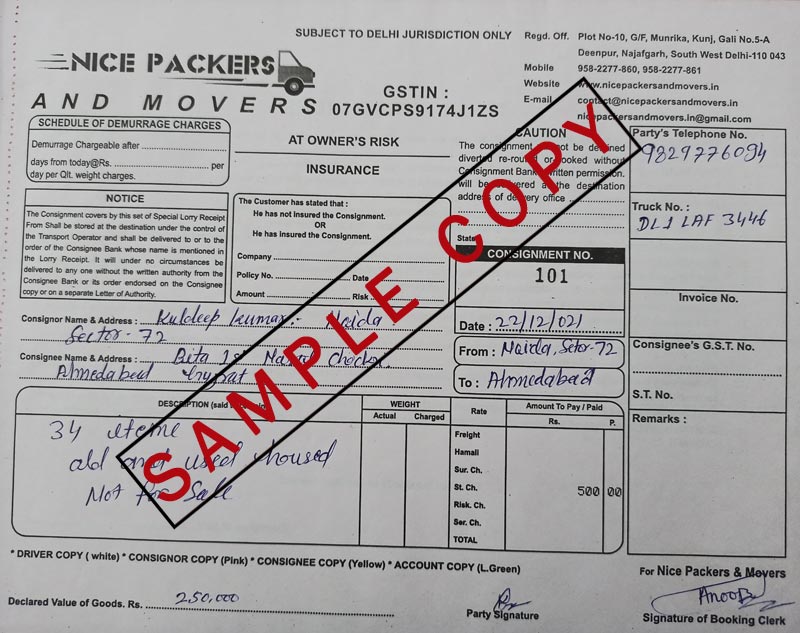

- Consignment copy

- GST No

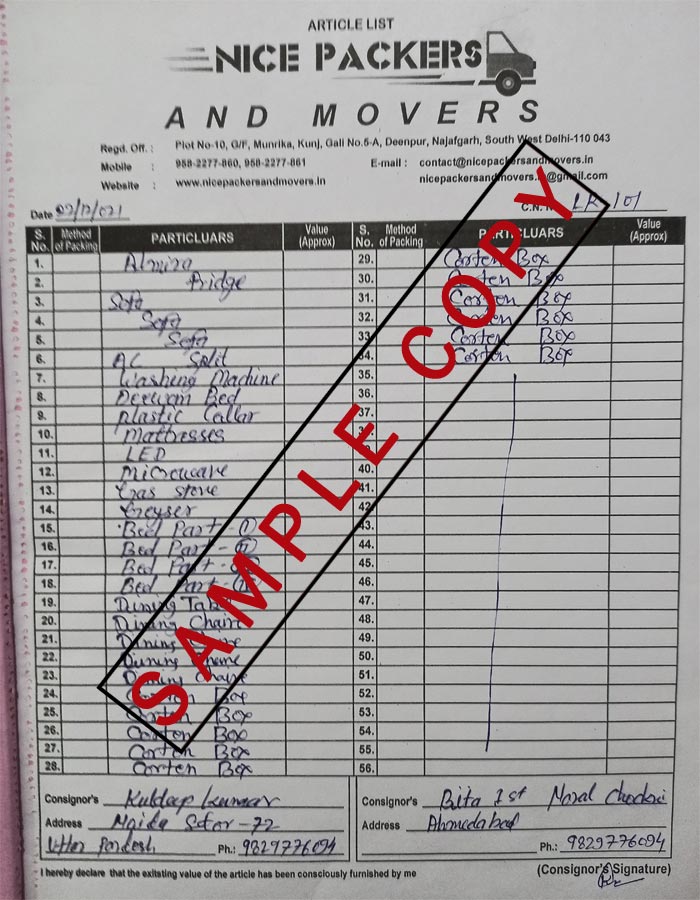

- List of items

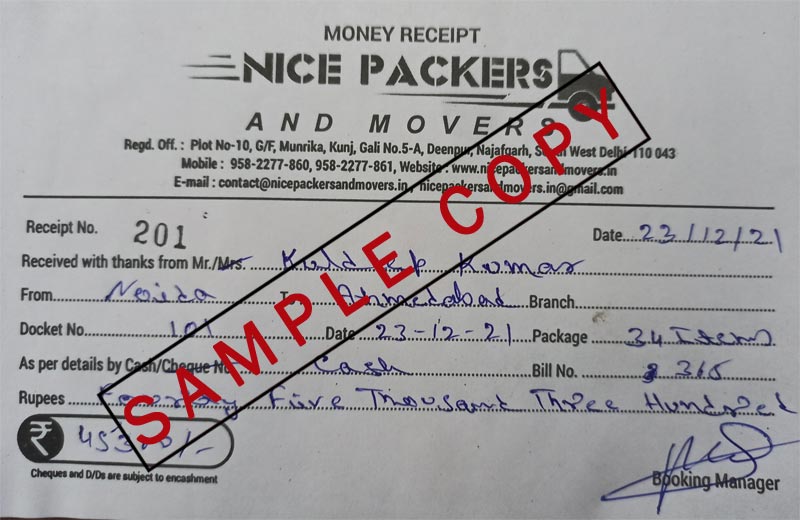

- Money receipt.

Quotation Copy

Packing/Goods List

Consignment Copy

Money Receipt if Needed

With the help of the above-mentioned documents, you can easily claim your shifting allowance so if you have any requirement to generate a Hyderabad to Delhi packers movers bill or anywhere in India we are here to help you.

What is The Process of Reimbursement?

Once you have got the invoice with other documents you have to follow these steps.

- Combine every document in a file and submit it to your HR department.

- Once the HR department approves these documents, you will be notified.

- You will get the reimbursement payment transferred to your account within 3-5 working days.

The payment terms and mode depends on company to company. Sometimes your employer will choose the shifting company or sometimes you will have the choice to choose the company.

Why Choose us?

Here are some of the reasons that sets apart from the crowd.

We provide 100% verified Home Relocation invoice in Hyderabad. Our clients get the bill with supporting documents which also include a GST stamp on the bill, ISO certified, and IBA approved.

Budget-friendly service, with our service we ensure to provide our clients with the best and budget-friendly services. We don't take any hidden charges or extra amounts.

Simple and genuine process, our company follows a simple and genuine process to generate Movers and packers GST bills Hyderabad. Our team understands your requirements and analyses them then we move to prepare documents.

We are there with you until and unless you get the reimbursement for your shifting. We assign a manager who will take care of your reimbursement process.

Our Home Shifting invoice Services Across India

Our Blog

What are Packers and Movers and What Do They Do?

So, you are here to know what is packers and movers. Well, they are generally known as moving companies.

List of 10 Best Cities for Jobs in India

It is really tough to get a job specially when you have done hard work with your degree. However, if you...

List of Highest Paying Jobs in India

Want to grow your carrier a looking for best opportunity then check these highest paying jobs in Inida...